What You Should Know:

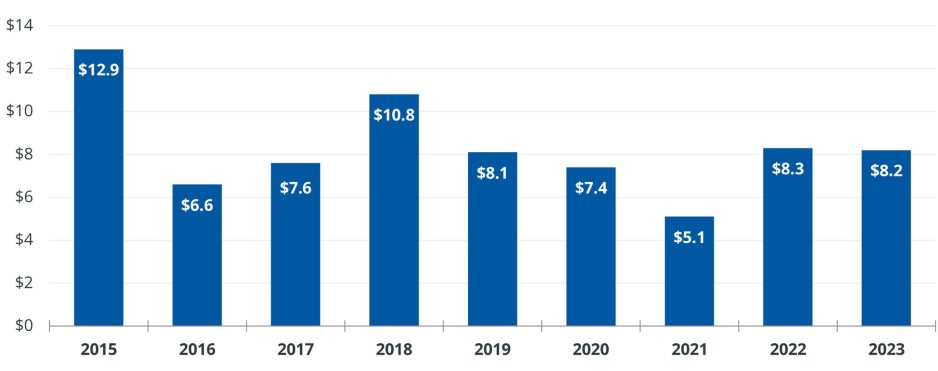

– More than one-third of hospital and health system transactions announced in Q3 2023 involved a party that cited financial distress as a transaction driver, according to Kaufman Hall’s latest mergers and acquisitions (M&A) report. The reports reveal third quarter M&A activity remained high with 18 announced transactions resulting in $8.2B in total transacted revenue.

– Kaufman Hall experts say transaction activity is regaining momentum as hospitals, health systems, and other healthcare organizations seek new alliances, partnerships, and ultimately, long-term financial sustainability.

– Despite only one “mega-merger” transaction—in which the smaller party has annual revenues above $1 billion—Q3 average seller size and total transacted revenue remain above historical levels.

Other key findings from the report include:

– Not-for-profit health systems were the acquiring or larger party in 14 of Q3’s 18 announced transactions, with for-profit systems acting as the acquiring party in the remaining four transactions.

– Of the 14 not-for-profit acquirers, seven were academic/university-affiliated organizations (see discussion below) and one was a religiously affiliated organization.

– The four transactions in which a for-profit system acted as acquirer focused primarily on smaller, financially distressed organizations: three of the four acquired organizations were financially distressed.